Taiwan Semiconductor's Bold Move

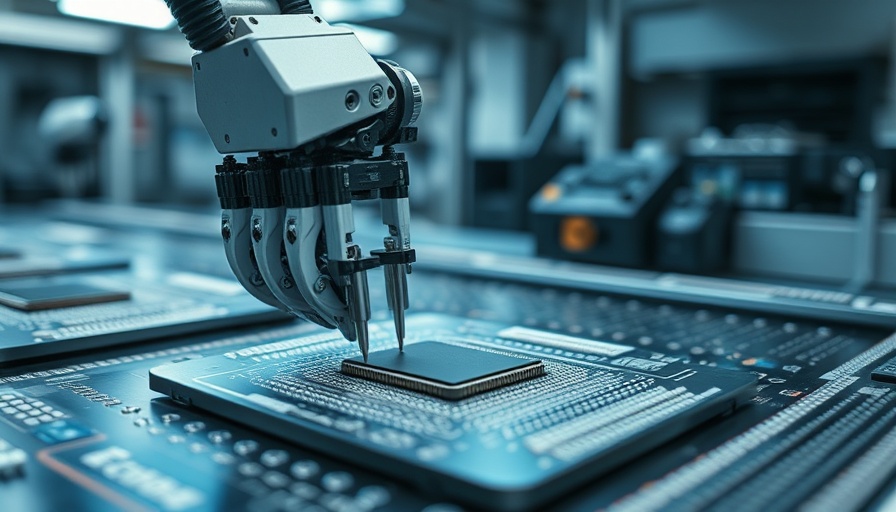

The semiconductor industry is witnessing a seismic shift as Taiwan Semiconductor Manufacturing Company (TSMC) makes waves with a whopping $100 billion investment in U.S. manufacturing. This move includes plans for expanding fabrication plants, packaging factories, and a research center, consolidating TSMC's foothold in the competitive landscape while posing significant challenges for its archrival, Intel.

Intel's Struggles in the Spotlight

Despite receiving considerable support from the U.S. government, including financial backing through the CHIPS and Science Act, Intel finds itself facing escalating struggles. The company reported a decline in its foundry business, raising alarms about its ability to keep pace with TSMC, which dominates nearly 60% of the global foundry market. While Intel's overall revenue barely shifted, its foundry business saw a worrying drop, exacerbated by delays in opening new manufacturing facilities. The delay of their Ohio plant until 2030 adds further to Intel's woes, leading analysts to question its strategy.

TSMC's Strategic Advantage in the AI Era

As major technology companies ramp up investments in artificial intelligence (AI), TSMC is positioning itself as a pivotal player in the market. By establishing deeper ties with AI giants like Nvidia and AMD, TSMC is leveraging its manufacturing prowess to gain competitive advantages. Investors are starting to view TSMC's strategic moves, which also include advancements in their Foundry 2.0 model, as powerful indicators of their growing dominance in chip production.

What Lies Ahead for Intel and TSMC?

The future of the semiconductor landscape seems to hinge on whether Intel can regain its footing amid fierce competition. While Intel's IDM 2.0 strategy aimed to reclaim its status, many industry experts remain skeptical of its effectiveness. With TSMC's continued innovations, particularly in advanced manufacturing processes, the pressure is mounting for Intel to deliver results. The competition not only highlights the challenges facing Intel but also underscores the critical nature of market dynamics in the global tech arena.

Summary of Tech Industry Insights

In light of TSMC's monumental investment and Intel's faltering momentum, understanding these developments is crucial for anyone interested in the tech industry. For investors, tech enthusiasts, and market analysts, the trajectory of these semiconductor giants will shape the evolution of AI technology and the global supply chain.

Add Row

Add Row  Add

Add

Write A Comment