The Importance of Understanding Sales Tax Rates

As we look ahead to 2025, understanding the dynamics of state and local sales tax rates becomes increasingly critical, especially for consumers and businesses alike. Sales taxes play a significant role in funding state and local services, making up 32% of state tax collections and 13% of local taxes. This reliance on sales taxes can often drive individuals to make purchasing decisions based on where they can find the best rates.

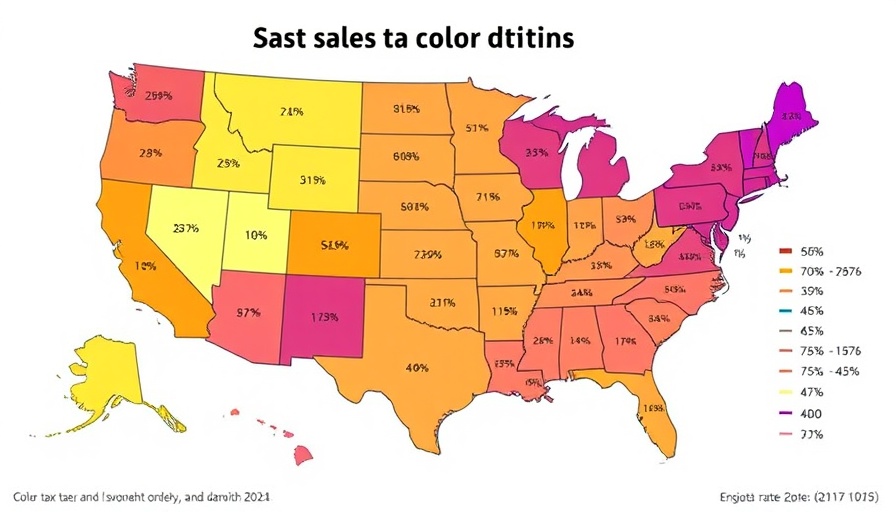

Examining the Highest and Lowest Sales Tax States

Among the states, Louisiana stands out with the highest average combined sales tax rate at 10.12%, followed closely by Tennessee at 9.56%. Alabama and Arkansas also feature prominently with rates around 9.43%. In contrast, Alaska leads the pack with the lowest average rate at just 1.82%, followed by Hawaii and Wyoming, which highlight a stark disparity across different states. Such variations can significantly impact consumer behavior, encouraging shoppers to seek out deals across state lines or even online — an option that's easier than ever in our digital age.

Shifting Consumer Behavior in a Changing Tax Landscape

Every penny counts when it comes to shopping, and high sales tax rates can lead consumers to rethink their purchasing habits. For instance, Tennessee's decision to forego a personal income tax while implementing higher sales tax can lure consumers looking for tax advantages. In contrast, states with no sales tax, like Oregon, impose heavier income taxes, creating a different economic landscape for residents.

Sales Taxes in Context: A Broader Economic Perspective

While sales tax rates are important, they are only part of a larger tax structure that affects economic decisions made by individuals and businesses. Understanding these tax structures can provide insights into overall fiscal health and business attractiveness in a state. Policymakers hold the reins on these rates, making them an essential tool for economic development and revenue generation.

Add Row

Add Row  Add

Add

Add Row

Add Row  Add

Add

Write A Comment