Impending Tariff Changes: What Tax Paypayers Need to Know

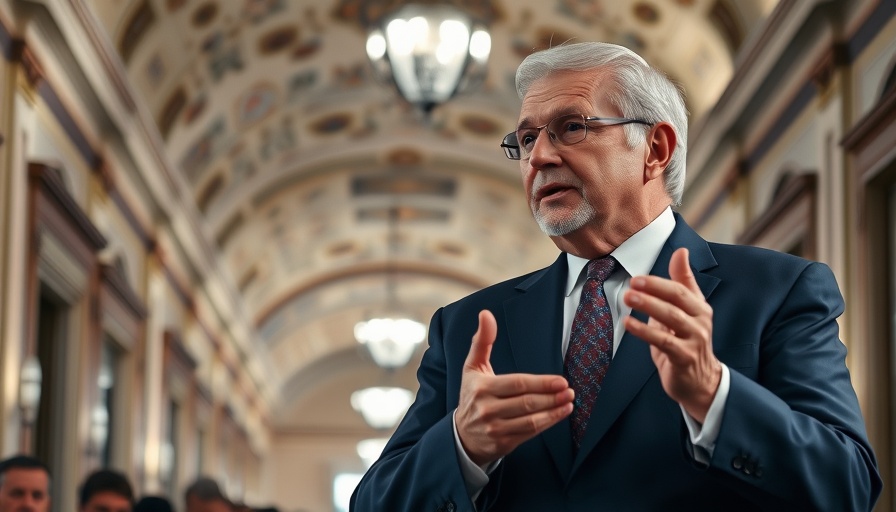

In a recent announcement, U.S. Treasury Secretary Scott Bessent revealed a stimulus for taxpayers and the economy on a complex issue: tariffs. He stated that tariffs, initially announced in April, are set to return to their previous levels on August 1 for countries that have not made progress in trade negotiations with the Trump administration. This move could lead to significant impacts on consumer prices and the overall economy, directly affecting taxpayers' wallets.

Understanding the Tariff Timeline

Bessent clarified that the announcement is not just a typical deadline; rather, it is a firm notification for trading partners. Countries failing to reach agreements with the U.S. will face tariffs reverting to levels established earlier this year. As Bessent noted, "This is when it's happening, if you want to speed things up, have at it.” This statement holds potential implications for economic conditions that may affect tax policies and deductions.

Potential Economic Outcomes

Tariffs directly influence supply chains and can lead to increased prices for imported goods, which taxpayers ultimately feel. With the potential return of these tariffs, families and small business owners may find that rising costs impact their budgets and tax liabilities. For those looking to lower my taxes, understanding how these tariff changes affect pricing strategies is essential.

Trade Deals on the Horizon?

Bessent hinted at upcoming announcements regarding trade deals, which could change the landscape drastically. Successful negotiations might alleviate pressure on consumers and foster a more favorable economic environment. For small business owners, this evolving situation presents opportunities for strategic tax planning and savvy deductions to mitigate potential increases in operational costs.

What’s Next for Taxpayers?

With turbulent trade agreements, it’s vital for taxpayers to stay informed. Being proactive in planning is crucial – consider engaging a tax advisor to explore small business tax deductions and other deductions that could benefit you amid the changing economic landscape. Adapting to potential changes through informed tax planning can maximize savings in the months ahead.

As we approach the August 1 deadline, now is the time to reevaluate your financial strategy and ensure that your tax strategies align with potential future shifts in the economic infrastructure.

Add Row

Add Row  Add

Add

Write A Comment