Understanding Cigarette Taxes in the EU

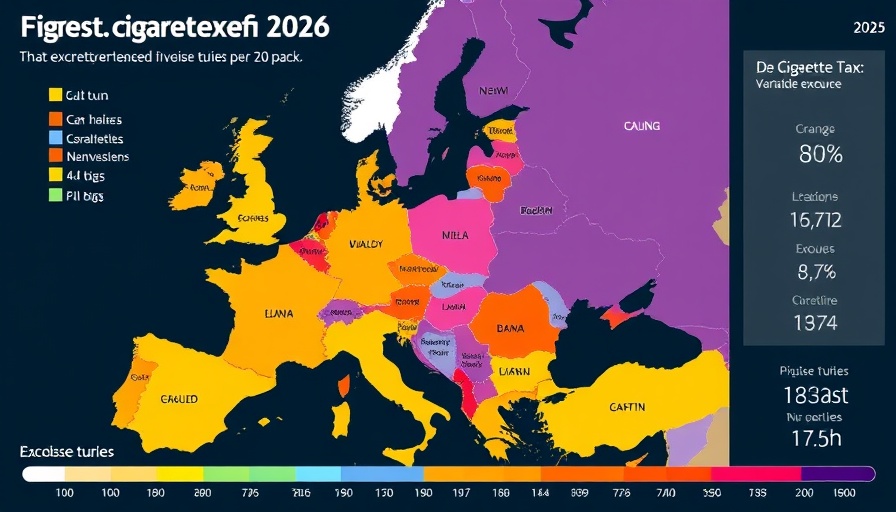

In 2025, cigarette smokers across the European Union are facing hefty excise taxes that often exceed the actual purchase price of tobacco products. The EU Tobacco Tax Directive mandates that all Member States enforce minimum excise taxes on cigarettes, set at €1.80 (around $2.12) per pack of 20 cigarettes. Additionally, consumers are subject to ad valorem excise taxes, which are percentage-based fees based on the retail price, further inflating costs.

Interestingly, while these minimum rates were established years ago, many countries choose to levy even higher excise taxes to combat tobacco use. For example, Ireland imposes a staggering €10.71 ($12.64) per pack, making it the highest in the EU. In stark contrast, cigarette taxes are much lower in countries like Bulgaria, which charges only €2.03 ($2.39) per pack.

Future Implications of the Tobacco Tax Directive

The current directive dates back to 2014 but is expected to be revised, likely resulting in increased minimum tax rates. This potential increase reflects a broader EU strategy aimed at reducing smoking rates among its population. As more countries prioritize public health, the financial burden on smokers may increase, raising questions about the effectiveness of such taxation on reducing overall tobacco consumption.

Cultural Reflections on Smoking and Taxation in Europe

The stark variations in cigarette taxes among EU Member States illustrate differing national attitudes towards smoking and health. While some countries view high taxes as essential for public health, others struggle with the economic implications for local businesses and smokers. This divergence not only highlights the complexity of tobacco regulation but also represents a broader conversation about health, society, and the state's role in personal choices.

The Broader Economic Context

Furthermore, excise taxes play a significant role in government revenue streams. As nations continue to navigate the balance between public health and economic viability, understanding the implications of these taxes becomes crucial for citizens and policymakers alike.

Add Row

Add Row  Add

Add

Write A Comment