RCI Executives Indicted in Elaborate Bribery Scheme

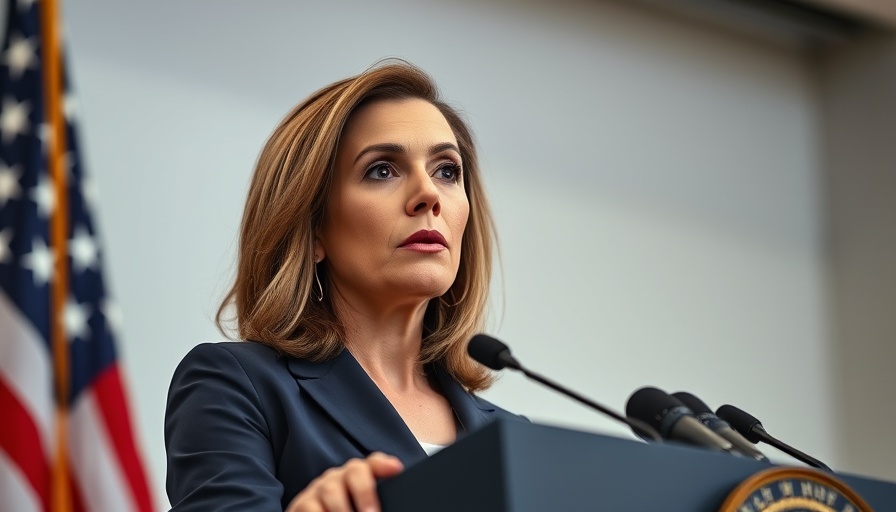

In a shocking turn of events, five top executives from RCI Hospitality Holdings, including CEO Eric Langan, have been indicted for a multi-million-dollar bribery and tax fraud scheme. The New York Attorney General, Letitia James, disclosed that this complex operation helped RCI defraud the state out of over $8 million in taxes from 2010 to 2024.

How The Scheme Worked

According to officials, the executives allegedly provided a New York Department of Taxation and Finance auditor with lavish gifts, including 13 complimentary trips to Florida. During these trips, the auditor reportedly received up to $5,000 per day in "private dances" at RCI-owned strip clubs, notably Tootsie's Cabaret in Miami. This arrangement raises significant ethical concerns about the relationship between private businesses and public officials.

Implications for Taxpayers

This case highlights the importance of maintaining integrity in tax reporting and auditing processes. For ordinary taxpayers, the repercussions of this kind of fraud are staggering. When businesses evade taxes, the financial burden often shifts to honest taxpayers who fulfill their obligations. This situation underscores the need for vigilant oversight in tax planning and enforcement to protect the interests of the public.

What Affected Taxpayers Should Consider

For individuals and small business owners, it serves as a reminder to engage in savvy strategic tax planning to ensure compliance and avoid potential pitfalls. Utilizing legitimate deductions, such as small business tax deductions, not only lowers your taxes but reinforces honesty in business practices. Knowledgeable tax planning can help you navigate potential challenges and maximize your financial situation.

Be Aware of Tax Risks

The allegations against RCI's executives serve as a crucial lesson. Taxpayers must be aware of the risks inherent in tax dealings and ensure that they are not inadvertently caught in unethical schemes. Staying informed about tax regulations and utilizing proper deductions can empower taxpayers to make smart financial decisions.

Final Thoughts

The indictment of RCI Hospitality executives is a wake-up call for the necessity of ethical practices in business operations and government oversight. If you want to effectively manage your taxes, it’s essential to engage with the right tax planning strategies to safeguard your financial well-being.

Add Row

Add Row  Add

Add

Write A Comment