Trump's New Merchandise Sparks Speculation

In a move that has set political circles abuzz, the Trump Organization has launched a line of apparel emblazoned with "Trump 2028." This merchandise revival raises probing questions about former President Donald Trump's intentions regarding a potential third term, despite the restrictions imposed by the 22nd Amendment of the U.S. Constitution, which limits presidents to two elected terms.

What the Constitution Says

The 22nd Amendment clearly states that no person shall be elected to the office of the President more than twice. Trump, elected in 2016 and again in 2024, could only seek a third term through a significant constitutional amendment—a daunting task. It’s crucial to remember that while the prospect of amending the Constitution is theoretically possible, it requires overwhelming political consensus.

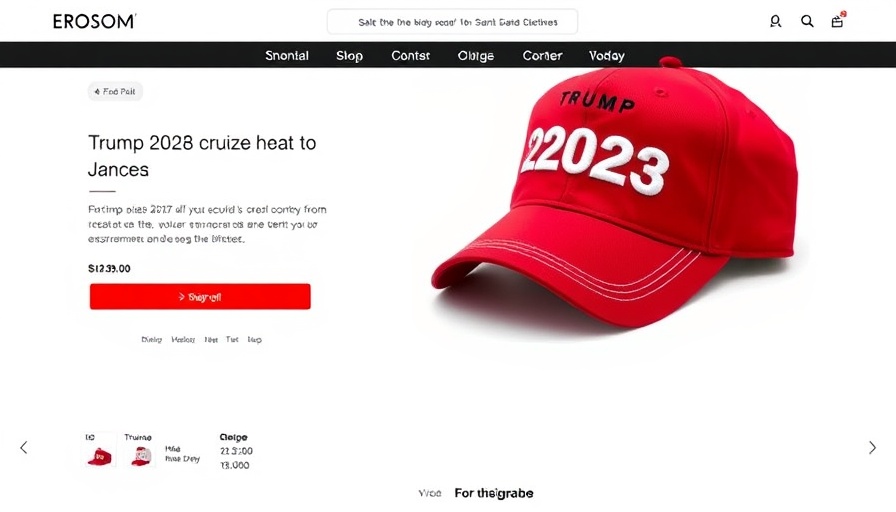

Apparel as a Political Statement

Starting Thursday, the Trump Organization's online store began selling red baseball caps for $50 and T-shirts for $36, earning quick traction among supporters. Notably, White House officials commented on the merchandise, with Press Secretary Karoline Leavitt playfully acknowledging its appeal, suggesting that regardless of the political implications, the items may prove popular among the former president's base.

The 'Trump 2028' Hype

Trump himself has hinted at the idea of pursuing a third term. In a recent interview, he remarked, “A lot of people want me to do it,” highlighting the interest from supporters. However, he maintains that it is too early to consider such a run seriously. Trump's comments point to a careful strategy; building anticipation could galvanize his supporters while keeping him in the political conversation.

Public Reaction and Political Implications

This merchandise launch reflects not just Trump's brand strategy but also the pulse of his loyal constituency. The intersection of merchandise and political ambition is potent; it not only signals Trump's sustained relevance but also energizes his base as the potential future of his political journey unfolds. For taxpayers and monitoring citizens, these developments could offer insights into forthcoming policies and campaigns.

As the conversation surrounding Trump's future continues, taxpayers and small business owners should remain informed and agile in their tax planning strategies. With discussions already surfacing about what a potential Trump presidency may entail, focusing on financial deductions and tax strategies could be vital for optimizing one’s financial landscape in uncertain political climates.

Conclusion: Stay Informed

As we navigate these shifting political currents, staying informed about potential election candidates and their implications for policy is crucial. Understanding the ramifications surrounding Trump’s merchandise and claims can provide insights into future tax implications, especially for small business owners and taxpayers. Planning ahead can ensure you’re ready for whatever political landscape unfolds.

Add Row

Add Row  Add

Add

Write A Comment