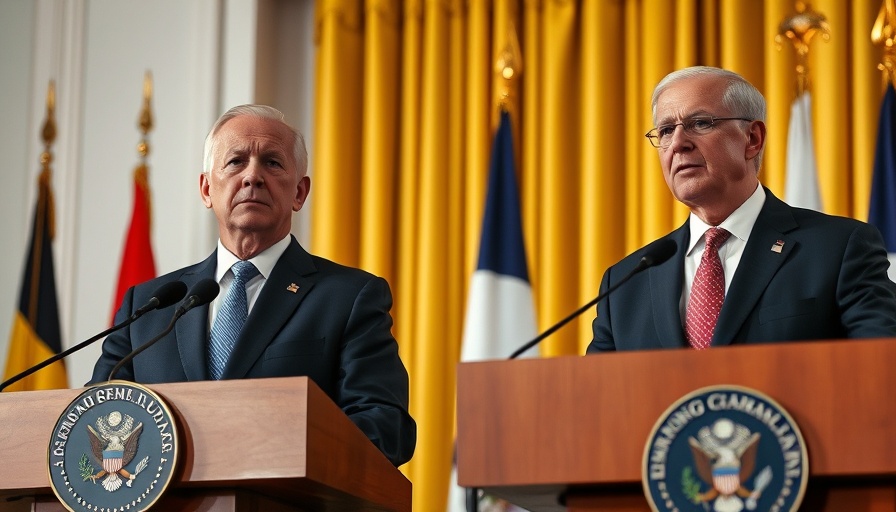

Trump and Macron: A New Era of Diplomacy Amidst Uncertainty

On February 24, 2025, President Donald Trump and French President Emmanuel Macron convened at the White House for a pivotal press conference, marking a significant moment amidst escalating international tensions resulting from Russia's ongoing invasion of Ukraine. As the third anniversary of the conflict looms, their discussions could potentially shape the future of transatlantic relations.

Joint Goals: Ending the War in Ukraine

Both leaders expressed a strong commitment to peace in Ukraine, with Trump characterizing their meeting as an "important step" towards ceasing hostilities. As he noted, every leader participating in the earlier Group of Seven nations' conference emphasized the need for an end to the war, highlighting a united front against aggressors. Macron, recognizing the strategic partnership between France and the U.S., reiterated the necessity of not succumbing to demands that undermine Ukraine's sovereignty.

The Search for Stability: Insights from Their Discussions

Macron emphasized, “This peace must not mean a surrender of Ukraine. It must allow for Ukrainian sovereignty.” This sentiment reveals the delicate balance leaders must navigate — advocating for peace while ensuring that territorial integrity is respected. Trump's acknowledgment of the need for a deal that grants access to Ukraine’s critical minerals aligns with broader interests, especially as the U.S. aims to bolster its tech and defense sectors.

Potential Shifts in Foreign Policy Direction

This meeting signals a pivotal shift in U.S. foreign policy under Trump, diverging from the strategies of previous administrations. Trump’s willingness to re-engage with Russian President Vladimir Putin is indicative of a broader shift towards negotiating peace through economic incentives, despite concerns regarding the implications for European unity. With whispers of economic deals and discussions surrounding security guarantees, the meeting raised questions about the U.S.'s future role in the region.

Engaging with the Audience: What This Means for Taxpayers

For taxpayers, these international negotiations may have significant ramifications. With a potential focus on resource agreements involving Ukrainian minerals, American tax dollars allocated for military assistance could effectively transition towards strategic trade deals. Understanding how these diplomatic developments interplay with domestic fiscal strategies can empower taxpayers to engage in discussions about legislative action pertaining to international economics.

Looking Ahead: A Climate of Uncertainty

As this administration seeks to redefine relations with Russia and its allies, taxpayers should remain vigilant. Participation in these global initiatives, while seeking to lower taxes and exploit industry opportunities, will require astute planning and active engagement. Enduring fluctuations in U.S. foreign aid and militaristic commitments will undoubtedly resonate throughout the economy, influencing not just international policy but also local financial health.

As taxpayers, it’s crucial to stay informed about these developments and consider actively participating in discussions surrounding fiscal policies. Utilize savvy strategic tax deductions and plan future expenditures to mitigate potential tax burdens resulting from these international engagements.

For continued insights and actionable tax pointers, especially in aligning personal finance with international developments, be sure to stay connected with leading economic updates and analyses.

Add Row

Add Row  Add

Add

Write A Comment