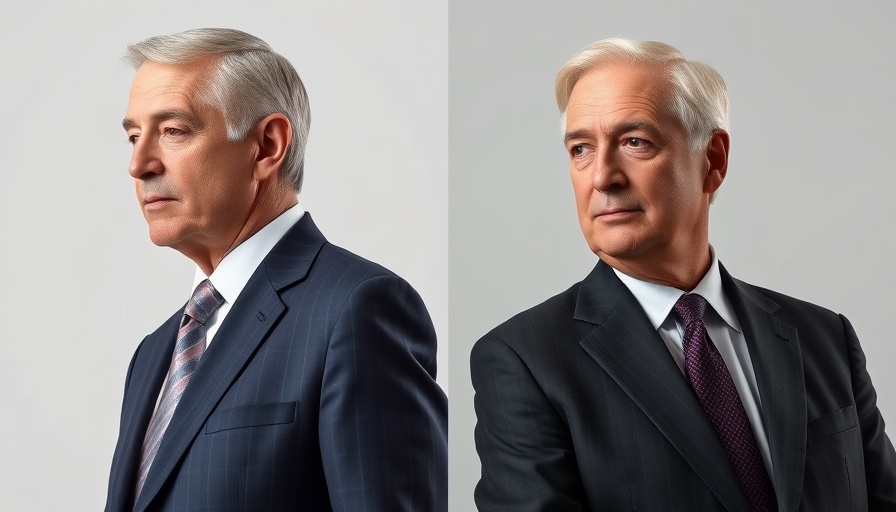

Trump and Murdoch: A Legal Showdown Over Defamation

In the latest chapter of a high-stakes legal battle, former President Donald Trump is pushing for a swift deposition from media tycoon Rupert Murdoch. This request is part of Trump’s $10 billion defamation lawsuit centered around an article published in the Wall Street Journal, which claims Trump sent a questionable birthday letter to the notorious sex offender Jeffrey Epstein back in 2003.

Why Urgency? Murdoch's Age and Health

Trump's legal team is citing Murdoch’s advanced age and health concerns as reasons to expedite the deposition. At 94 years old, Murdoch has had significant health issues in the past, raising concerns that he may be unable to testify in the future. This urgency ties into a broader narrative of aging leadership within both media and politics, where the implications of health can directly affect high-profile legal cases.

The Stakes of Public Image

The very nature of this lawsuit points not only to Trump's own reputation but also to the complex relationships between powerful figures in media and politics. As taxpayers, it is crucial to consider how personal disputes among billionaires could potentially involve public resources or influence public policy. Trump’s legal strategy highlights a deeper concern over how media representations can impact personal and political narratives.

What’s Next for Trump?

This case highlights broader issues related to defamation and the influence of media in shaping a public figure's legacy. Taxpayers should be aware of the ramifications such court cases could have, not only on the parties involved but on societal perceptions as a whole. Furthermore, with advances in tax planning becoming ever more critical, it’s a reminder to be vigilant about advocacy and protection in the face of evolving legal landscapes.

Every Taxpayer’s Role

As we observe these proceedings, it is an opportune moment for individuals and small businesses to remember the importance of savvy strategic tax deductions and effective tax planning. Staying informed about these matters can help lower my taxes and ensure that both personal and business financial health remains solid amidst legal uncertainties.

Add Row

Add Row  Add

Add

Write A Comment