Trump's Controversial Comments Stirr National Dialogues

Recently, former President Donald Trump sparked outrage with a comment suggesting he would revoke comedian Rosie O'Donnell's citizenship. This declaration, made in a public address, not only reignited conflicts between Trump and prominent figures but also stirred conversations about the implications of political rhetoric on citizenship and American identity.

The Weight of Words in Political Discourse

Such statements raise questions about how political leaders use language to impact public opinion. For many taxpayers, understanding the gravity of comments regarding citizenship is essential, as it touches the core of democratic values. As conversations shift towards the impact of political statements on the public, it’s important to consider how this affects relationships between entertainers and politicians.

Implications for Public Figures

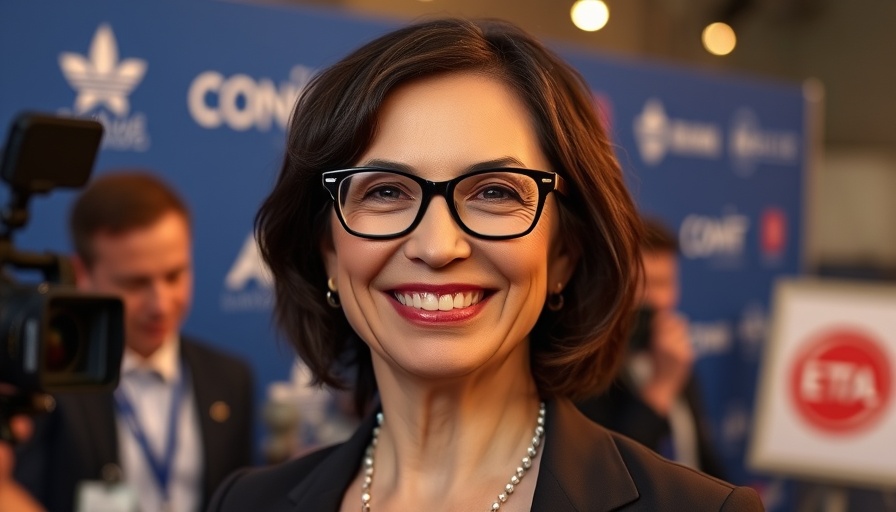

O'Donnell, known for her outspoken nature, has had a tumultuous relationship with Trump. Her citizenship being questioned could be viewed as a tactic to silence dissenting voices in media. As taxpayers, we should follow these dynamics and consider how they reflect broader societal trends.

A Call for Civility and Respect

This incident highlights the need for civility in public discourse. As we navigate the complexities of political engagements, finding common ground and reducing hostility should be priorities for all parties involved. Recognizing the human aspect of citizenship and public life is crucial for fostering a healthier political climate.

What Can We Learn?

As taxpayers and engaged citizens, it’s vital to reflect on the influence political actions and words have on our society. We can stand firm in our beliefs while promoting respect and understanding towards others. Now more than ever, it is critical to demand dialogue that fosters unity rather than division.

It may be advantageous to explore the realm of tax planning. With the right knowledge of deductions available, whether you are a small business owner or simply seeking ways to lower your taxes, proactive strategies can make a significant difference.

Add Row

Add Row  Add

Add

Write A Comment