Understanding the Impending Tariffs and Their Impacts

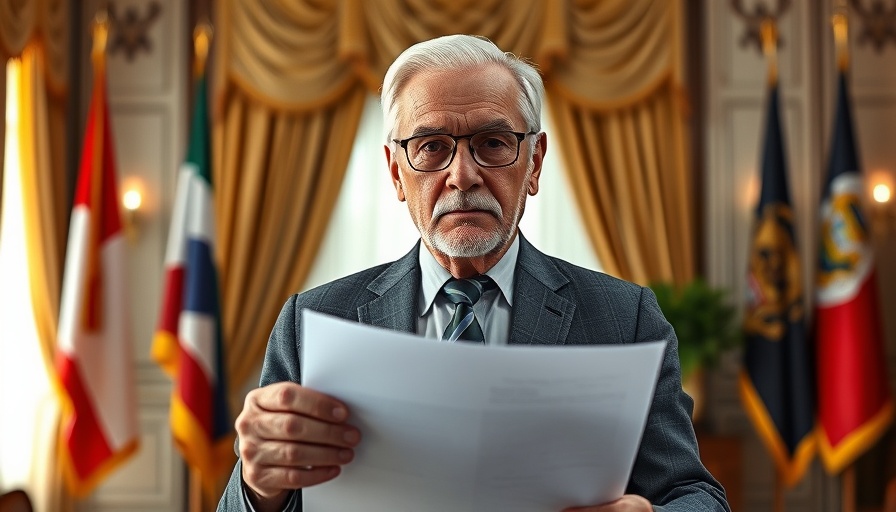

In a time of uncertainty, U.S. Commerce Secretary Howard Lutnick has taken a firm stance, confirming that the administration will proceed with significant tariffs set to launch on April 9. This assertive affirmation comes amid a considerable sell-off in global markets following President Trump's announcement of a 10% duty on all imports, alongside increased tariffs on imports from 57 major trading partners.

Lutnick’s unwavering comments—'The tariffs are coming'—highlight the administration's commitment to adjusting the international trade landscape, a move that could affect taxpayers and small business owners alike. As the markets react to these developments, Lutnick maintains that there will be no delays in implementing these tariffs, signifying a defining moment in trade policy that could reshape economic relations with other countries.

Market Reactions and Financial Implications

The immediate aftermath of Trump’s tariff declarations saw global stock markets plummet, experiencing a substantial loss in value—$7.46 billion, according to reports. Such fluctuations may pose challenges for American taxpayers, especially small to medium business owners who depend on steady market conditions. Understanding these dynamics is essential for effective tax planning and managing deductions strategically in such turbulent times.

Preparing for the Future and Tax Strategies

Taxpayers need to be proactive in navigating the financial landscape affected by these tariffs. It's crucial to explore available deductions and tax planning strategies to mitigate potential impacts. Smart decision-making now can lower tax liabilities and enable businesses to allocate resources effectively in the face of rising costs linked to increased tariffs.

What This Means for Taxpayers

The looming tariffs could lead to higher prices for imported goods, which may translate into financial strain on consumers. Taxpayers should remain informed and consider how these changes affect personal finances, especially if they operate small businesses that rely on imported materials. Keeping abreast of tax help resources and potential deductions could ultimately safeguard financial stability during these unpredictable times.

To stay ahead amid these economic fluctuations, taxpayers are encouraged to engage with financial advisors for personalized tax planning strategies that capitalize on available deductions, including savvy strategic deductions aimed at easing the tax burden. As the landscape evolves, an informed and proactive approach is essential.

Add Row

Add Row  Add

Add

Add Row

Add Row  Add

Add

Write A Comment