Trade Deal Teases Progress Amid Market Volatility

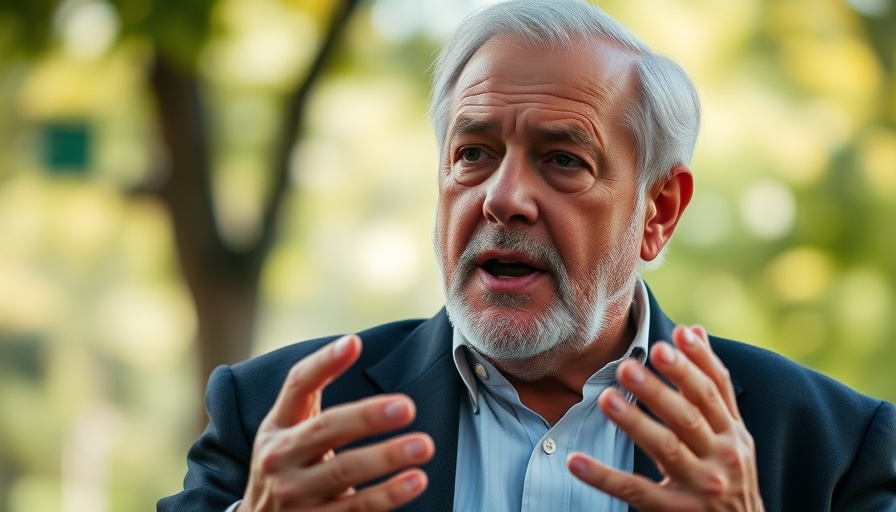

In a noteworthy turn of events, U.S. Commerce Secretary Howard Lutnick announced that a significant trade deal is reportedly finalized but awaits approval from an unnamed country's government leaders. His bold declaration comes as U.S. markets react positively, demonstrating heightened optimism stemming from potential trade resolutions. As the stock market enjoyed a surge following Lutnick's comments, it is clear that investors are eager to see tangible progress in U.S. trade relations, especially in light of recent uncertainties surrounding tariffs.

Lutnick's assurance that he has a deal 'done, done, done' may provide a glimmer of hope for taxpayers and business owners who have been navigating a turbulent economic landscape. The uncertainty surrounding trade agreements has already led to fluctuating stock values and declining confidence among consumers and business leaders, as indicated by numerous surveys. Lutnick stressed that his focus does not include negotiations with China, which are reportedly under the purview of Treasury Secretary Scott Bessent.

What This Means for Taxpayers and Small Businesses

For taxpayers, particularly in the realm of small to medium business ownership, Lutnick's announcement could indicate improved market conditions that may ultimately lead to lower tax burdens. As businesses stabilize due to clearer trade frameworks, savvy strategic tax deductions might pave the way for increased profitability. Understanding how new trade dynamics impact tax planning is crucial for maintaining financial health.

A Look Ahead: What’s Next for Economic Relations?

The anticipation of the unnamed country's government approval adds an interesting twist to this ongoing saga. As the landscape of international trade evolves, taxpayers should prepare for changes that might affect their financial planning and tax strategies. The outcomes of these negotiations could usher in new opportunities for deductions and financial relief.

Final Thoughts on Trade and Tax Planning

For taxpayers, especially those in the demographic of 25 to 65 years old, staying informed about trade developments can significantly impact financial strategies. As trade agreements unfold, paying attention to how they influence tax deductions can assist individuals in minimizing their tax burdens. With the potential for new business-friendly policies emerging, this is the time to consult with tax professionals to strategize effectively.

Add Row

Add Row  Add

Add

Add Row

Add Row  Add

Add

Write A Comment