Understanding Capital Gains Tax in Europe for 2025

The capital gains tax (CGT) landscape across Europe is set for significant changes in 2025, reflecting the ongoing debate over taxation policies and their impact on investment. In various European nations, capital gains—profits made from selling an asset—are taxed differently compared to wage income. This disparity can significantly influence a person's decision to invest, save, or spend, impacting overall economic health.

What is Capital Gains Tax?

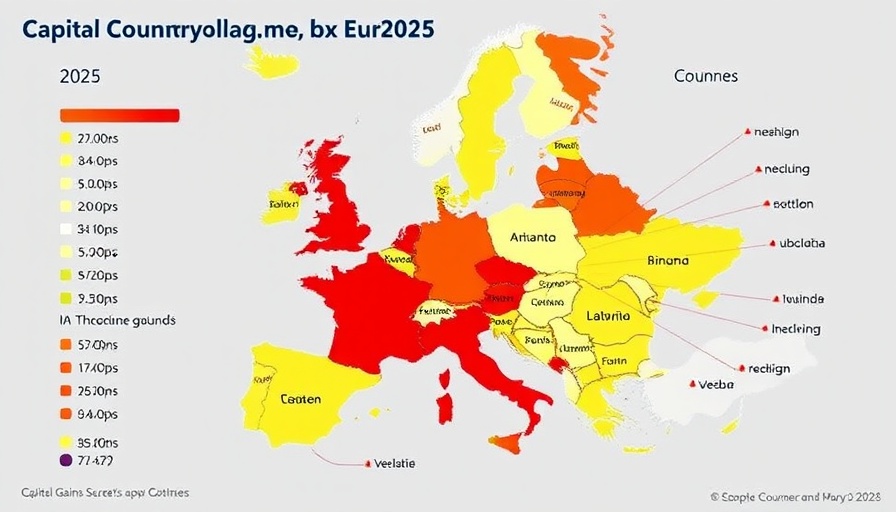

Capital gains tax is levied on the profit realized when an individual sells an asset for more than it was purchased. For instance, selling a share bought for €100 for €120 means that the seller must pay tax on the €20 gain. How this gain is taxed varies widely across Europe, reflecting different public policy priorities. In some countries, such as Belgium and Cyprus, there is no capital gains tax unless the gains are treated as professional income. In contrast, countries like Denmark impose a high rate of 42%, putting pressure on individuals looking to invest.

The Realization Effect: Why Tax Rates Matter

One core challenge stemming from capital gains taxation is the “realization effect.” High CGT rates can discourage investors from selling assets, which can stifle liquidity in the market. This lock-in effect can lead to fewer transactions, creating an environment where gains are not realized, thereby not generating revenue for governments that rely on these taxes. Instead of selling, individuals may hold onto their investments longer, which can lead to suboptimal economic outcomes.

Key Changes to Note for 2025

As we approach 2025, it's crucial to note that many countries are adjusting their CGT rates. For example, the UK has recently seen increases from 10% to 18% for basic rate taxpayers, and from 20% to 24% for higher rate taxpayers. Such changes signal a shift toward more progressive taxation, which aligns with broader movements in several European countries aiming for equitable wealth distribution.

The Impact on Investors and Small Business Owners

For small to medium business owners, understanding capital gains tax is vital for effective retirement planning and business strategy. Investors should keep an eye on these changes, particularly how they might affect purchases and sales of business-related assets. With the upcoming tax deadline, exploring existing exemptions and planning sales judiciously can help minimize tax liabilities while optimizing financial growth.

Additional Resources Available

For those seeking more nuanced information on capital gains taxes tailored to personal investment strategies, reviewing government publications and consulting with financial advisors may prove beneficial. Many investors overlook annual exemptions, which could reduce taxable gains and improve overall tax efficiency.

As tax landscapes evolve, staying informed and proactive about changes to capital gains taxation is essential for anyone looking to make sound financial decisions. The key takeaway is the importance of strategic planning in light of these changing tax rates to foster a healthy investment climate.

Add Row

Add Row  Add

Add

Add Row

Add Row  Add

Add

Write A Comment