Opportunity for Rebalancing: What It Means

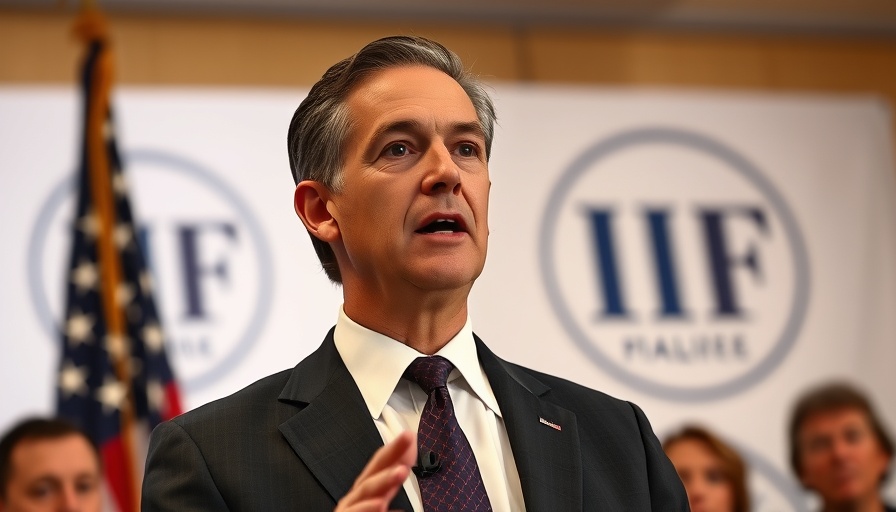

Treasury Secretary Scott Bessent recently highlighted potential trade discussions between the U.S. and China, announcing there is an opportunity for a significant deal. During his speech at the Institute of International Trade and Finance, he proposed a cooperative approach to trade rebalancing, indicating that if China is willing to negotiate, the U.S. is ready to engage.

Bessent emphasized that this moment could be transformative, likening it to what financial magnate Ray Dalio might call a 'beautiful rebalancing.' These comments come amid rising concerns around the effects of tariffs imposed during the Trump administration, which as high as 145% could impact consumers and businesses alike. Reports of potential reductions in tariffs to 50-65% signal a shift that could ease some of the pressures on the economy.

Impact of Tariffs on Taxpayers and Businesses

For many taxpayers, particularly those running small to medium businesses, high tariffs mean an inevitable increase in operational costs. These costs could negatively affect pricing and, in turn, profit margins. The Secretary's notion of revisiting these tariffs could be beneficial not only for international relations but also for enhancing tax planning strategies for domestic taxpayers. Lowering tariffs may lead to lower costs, potentially allowing owners to invest more in their businesses or even offer lower prices to consumers.

Expectations Moving Forward: A Holistic Approach

Bessent’s advocacy for reforming global financial institutions like the World Bank and IMF supports his vision for a balanced trade environment. Such reforms could lead to better support for industries impacted by global economic shifts, fostering an atmosphere where taxpayer interests are better represented. The incoming administration may also revisit domestic tax deductions based on these evolving trade landscapes, making savvy strategic tax deductions more accessible. It’s essential for taxpayers to remain proactive in understanding these developments as they shape future financial planning.

Why This Matters to You

As a taxpayer, your financial health depends significantly on the broader economic landscape. Engaging in this dialogue around trade can directly influence tax relief measures and deductions. Understanding how rebalancing trade with China could affect tariffs, and consequently your taxes, is vital. Therefore, staying informed not only helps you anticipate changes but also allows you to make strategic financial decisions, whether that includes understanding deductions available or how tariffs may affect your purchasing power in the near future.

Add Row

Add Row  Add

Add

Add Row

Add Row  Add

Add

Write A Comment