The Importance of Property Taxes in Local Funding

Property taxes stand as a critical source of funding for local governments across the United States, making up 27.4% of the total state and local tax collections as of the fiscal year 2022. From education to emergency services, these taxes play a vital role in maintaining the infrastructure of communities. They not only support public services but also help keep neighborhoods functioning smoothly by funding police, fire departments, and public schools.

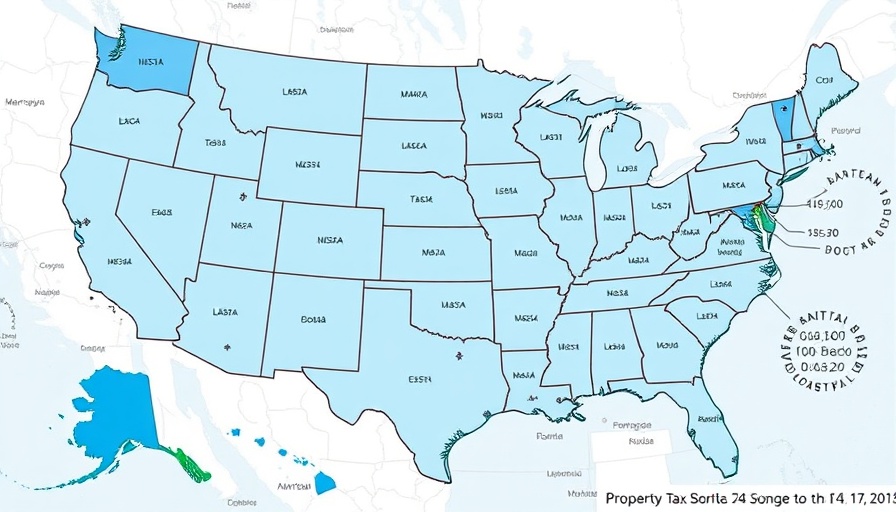

State Comparisons: Who Pays More?

The property tax landscape varies greatly from state to state. Looking ahead to 2025, New Jersey continues to lead the pack with the highest effective property tax rate at 2.23%, closely followed by Illinois and Connecticut. On the other end of the spectrum, Hawaii boasts the lowest rate at just 0.27%. Understanding where your state stands can significantly impact financial planning for homeowners and investors alike.

Why Higher Property Taxes?

High property tax rates often correlate with the overall cost of living in urban areas, where home values are significantly elevated. For example, property owners in Manhattan face median taxes much higher than the state average. Such differences can indeed inflate the financial burden on families living in densely populated regions, necessitating a careful review of the local taxation structure and what it funds.

Navigating Property Taxes: Practical Tips

For homeowners navigating property taxes, there are several strategies to consider. Regularly reviewing property assessments and understanding local tax rates is essential. If a homeowner feels their property is overvalued, they can appeal to local assessors for a reassessment. Searching for tax exemptions, particularly for primary residences or for seniors and veterans, can also modestly decrease tax obligations.

Looking Ahead: The Future of Property Taxes

As local governments continue to grapple with funding issues in the coming years, understanding the intricacies of property taxes will remain essential. With ongoing debates about tax reform and potential changes in taxation policies, staying informed will enable taxpayers to make well-rounded decisions that reflect both their needs and those of their community.

Add Row

Add Row  Add

Add

Add Row

Add Row  Add

Add

Write A Comment