Trump's Controversial NLRB Firing: A Court's Rebuttal

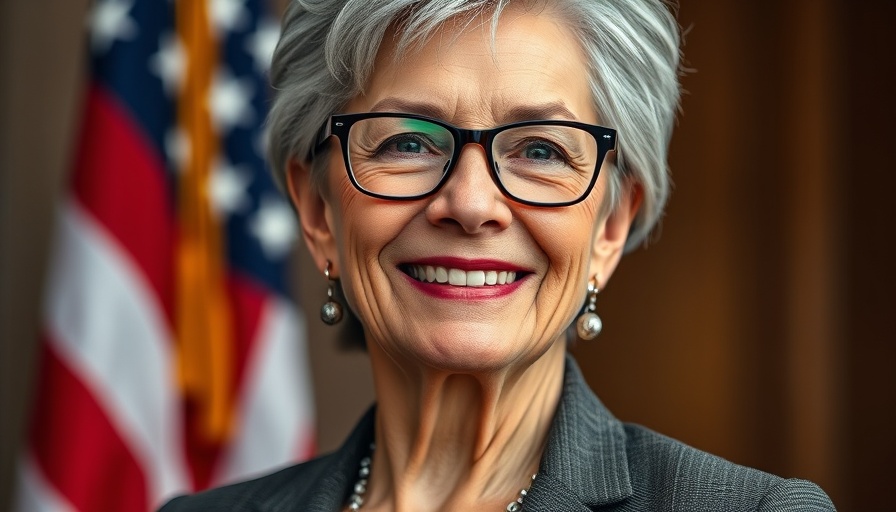

A federal judge has ruled against former President Donald Trump’s decision to fire Gwynne Wilcox, a member of the National Labor Relations Board (NLRB), declaring it illegal and a violation of the law. In a decisive ruling that underscores the separation of powers, Judge Beryl Howell stated, "an American president is not a king," emphasizing that the authority to remove NLRB members does not rest with the presidency alone.

Historical Significance of Wilcox's Firing

Wilcox’s removal marks a significant moment in U.S. labor law history—she is the first Board member ever to be dismissed by a sitting president since the NLRB was established in 1935. Her unexpected termination raised immediate concerns regarding presidential overreach and the potential implications for labor rights enforcement across the country.

Understanding the Legal Framework

The ruling is rooted in the National Labor Relations Act, which stipulates that members can only be dismissed for specific reasons such as misconduct or negligence. Wilcox’s attorney highlighted that this ruling is a critical affirmation of the NLRB’s independence and aims to protect the rights of American workers. This legal protection is crucial, especially as governmental decisions directly impact labor rights.

Future Implications for Labor Law

This legal battle indicates that disputes over labor governance might escalate, potentially reaching the Supreme Court. Legal experts suggest that this case could set significant precedents regarding the independence of federal agencies and the limits of executive power. Understanding these implications is vital for voters, especially as labor laws affect job security and workplace rights.

Taxpayers and Labor Rights

Taxpayers may view this litigation as representative of broader issues surrounding governmental authority and accountability. With increased discussions around labor rights, the outcome of this appeal could inform future tax policy debates—particularly regarding funding for labor enforcement agencies. Engaging in these discussions could empower taxpayers to advocate for fair labor practices while being aware of their tax contributions toward governmental oversight.

As this situation unfolds, taxpayers are encouraged to stay informed about how high-profile legal conflicts influence labor laws and their rights as workers. Knowledge about these dynamics can lead to more informed advocacy for labor rights, which, when coupled with savvy strategic tax deductions for small businesses, creates a balanced perspective on how governance affects personal finances.

In light of these developments, taxpayers should remain vigilant and engaged; understanding the broader implications of this ruling could very well shape future conversations around labor policies and their effectiveness in protecting workers’ rights.

Add Row

Add Row  Add

Add

Add Row

Add Row  Add

Add

Write A Comment